|

Did You Know...

It's New Year in Myanmar on the 17th April. Follow our blogs, posts and events. This year, we will give you more updates, stories and interesting facts about Myanmar. Don't miss out on little extras like great recipes, inside stories and more... Get our Myanmar Bulletin here If you are on our website, you clearly love making a difference. One Percent Collective is a tiny crew of two people making a BIG difference. OPC encourages Kiwis to give 1% of their income to their vetted, partner charities - in late 2018, ADC Microfinance cut the mustard and joined their list of supported charities.

Since December, 2018 their regular givers have contributed nearly $7000 to ADC Microfinance. 100% of that money has been passed on to us, to grow the capital pool in Myanmar. Thanks, OPC! The latest Generosity Journal Publication included an awe inspiring recount on how ADC was born. Have a read here.

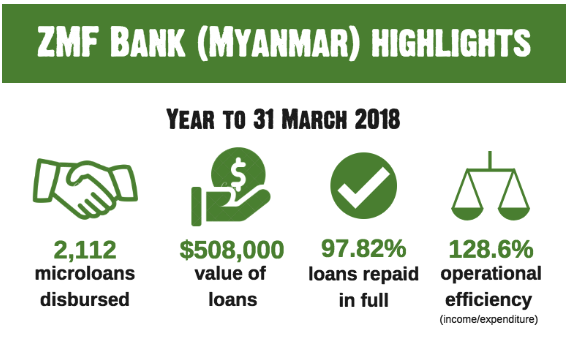

We are excited to announce that with your support, ADC Microfinance has enabled a remarkable 2,112 microloans in Myanmar worth NZ$508,000 over the past year. Empowering thousands of people to lift themselves and their families out of poverty is something we think is worth celebrating! We couldn't have done it without your support and want to extend a sincere thank you to our donors and supporters. Your generosity and support makes the work of ADC possible and helps to grow our impact each year. This past year has been the most successful yet in Myanmar. We've hit a new milestone of enabling 8,037 loans since ADC's inception - that's NZ$1.7 million in loans since ADC began working with ZMF Bank in Myanmar. Once repaid, loan funds are available to be lent out again and again, making microfinance one of the most sustainable forms of development and maximising impact. For every dollar invested by ADC into the ZMF Bank, over $6.50 has been distributed in loans. It has also been a big year for ADC in New Zealand. Our #GiveHerCredit network continues to grow, there has been great support through screenings of our On the Backs of Women film, and we have seen some fantastic peer-to-peer fundraising campaigns (such as supporters running marathons and racing up volcanoes to raise money for microfinance). The annual Gala Dinner and Quiz night continue to be hugely successful.

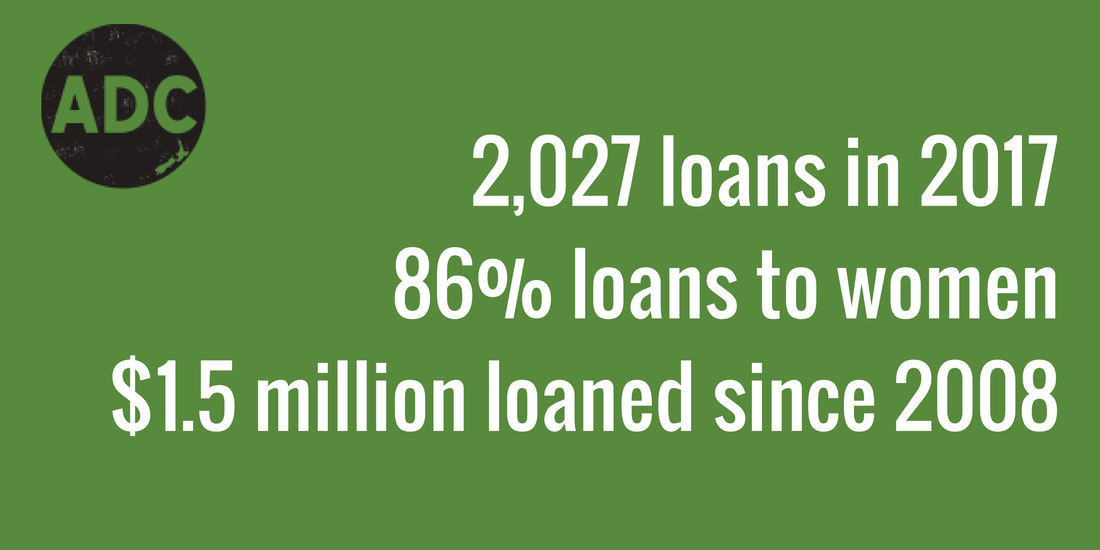

We can't wait to introduce you to some more ZMF Bank clients, and share some fun events coming up later in 2018. We would like to extend a heartfelt THANK YOU for supporting ADC in 2017 - for attending events, sharing our story with friends, donating to appeals, and getting behind our #BackAWoman campaign. A special thanks goes to our wonderful regular donors - your support really is the lifeblood of ADC that allows us to empower people to lift themselves and their families out of poverty. In 2017, our Myanmar partner ZMF Bank has continued to thrive and provide affordable credit to thousands of entrepreneurs in some of Myanmar's poorest communities. 2,027 loans were made, totalling $472,500. 86% of these loans were to women. Our growth last year shows the power of microfinance in action. Each time a loan is repaid, the money can be loaned out again to a new deserving client with big business dreams.

Microfinance is a lifeline in communities like Kalaymyo, Myanmar (where ZMF Bank operates), because of otherwise prohibitive interest rates. Many people are forced to turn to loan sharks and pawn shops, where interest rates can exceed a frightening 200% per annum. This is a prohibitive cost to starting a sustainable small-scale business for most people. ADC's micro loans give skilled, enterprising communities another option. Here are some highlights from the Myanmar project in 2017:

Here in New Zealand, we celebrated some great highlights in 2017:

On the Backs of Women is the award-winning documentary about three enterprising women living in poverty in Myanmar. It won "Best NZ Short" at the 2016 DocEdge film festival. The film follows the lives of three clients of ADC’s project partner in Myanmar and demonstrates the power of microfinance to change lives. ADC has been running a campaign encouraging people to host viewings of the film with friends, family or colleagues. In 2017 there has been a larger focus on corporates and other groups having viewings with staff and other associates. The interest and inspiration inherent in the stories the film portrays has encouraged a lot of support, raising almost $20,000 for ADC so far, with lots more to come! As well as in people's homes, viewings have been held in high schools, churches, workplaces, the Ice House Auckland (New Zealand entrepreneurs supporting entrepreneurs in Myanmar), the Australian/Myanmar Chamber of Commerce at their Women in Business conference, iProspect, and more to come. We are immensely grateful for all the support we have received! We have also recently added the film to our website. It's free to watch, and we welcome donations of any size if you feel you got some value from it or would like to support more women lifting their families and communities. Every $200 raised through the #BackAWoman campaign enables us to support another woman in Myanmar and their dreams for a better future. If you’d like to watch the film, host a viewing or help us share these amazing stories in any way then visit www.backawoman.com to sign up, or contact our campaign coordinator James at james.powell@adc.org.nz. Thanks again for all your continued support! Our Myanmar project has gone from strength to strength this year, and we're excited to update you on what's been happening. Demand for loans from ZMF is strong, and the repayment rate remains high (over 90% repayments on time). As loans are repaid, the funds are then able to be loaned out again to new (and repeat!) clients. We've now enabled an incredible 6,271 loans since inception (September 2008), totalling $1.258 million.

We have 1,371 current loans in circulation, and 86% of these are to women. Thank you to everyone who has generously supported ADC to empower these people to access microfinance and build a better future for themselves. Last month there was more flooding in Kalaymyo and surrounding areas, where ZMF Bank (our project partner) operates. This involved a few precautionary evacuations and interruption to some client businesses, but not on anything like the scale of the devastating floods of 2015. Floodwaters have now receded, and ZMF is working closely with those clients who are affected to ensure they have the necessary support (including re-structuring loans where necessary). Many ADC supporters will no doubt be aware of the current conflict in Rakhine State in Myanmar, and consequent humanitarian crises. At this stage it looks unlikely that the unrest will directly affect the areas in which ZMF (ADC's Myanmar project partner) operates, as these are a few hundred kilometres to the north of Rakhine. However, our thoughts are with the thousands of innocent people affected by the ongoing violence and displacement. 30 September 2017 saw the 10th instalment of the hugely popular annual ADC Quiz night. This year saw a few changes - a different venue and a new, automated quiz format using hand-held remotes.

The quiz was hotly contested between sixteen teams, with team "Foregone Conclusion" edging out the competition to take out first place and a fantastic prize pack. As usual we had both live and silent auctions with everything from baches to yoga passes, to pet photography, to a piece of traditional weaving from a client of the ZMF bank. The best news from the night is that we were able to raise over $16,500 to support our microfinance partners. This is the equivalent to at least 80 new loans - helping entrepreneurs in poor communities kick-start a small business and lift themselves and their families out of poverty. A huge THANK YOU to all who came along and made the night such a success! A big thanks to the hugely talented Anna Kennedy for being our MC and auctioneer for the night! And a special thanks also to Nevil and the team at Evolve for their generous support, and to everyone who donated prizes and auction items. We look forward to seeing you all again next year! ADC (which stands for Aotearoa Development Cooperative) was founded in 2007 by two university students from Auckland, New Zealand: Andrew Colgan and Geoff Cooper. This is their incredible story: "Backpacking through Asia with friends during the long university summer break, we were young, idealistic and on a budget. Myanmar sounded interesting – an adventure off the usual backpacker track. The country was not in great shape in January 2007, after decades of military rule and economic mismanagement. Severe poverty was entrenched, and political freedoms nearly non-existent. Yet many of the people we met in Kalaymyo (in northwest Myanmar) were talented, resourceful, business-savvy and ambitious. In spite of their circumstances, they seemed to have everything it might take to operate a successful small business. Well...almost everything. It soon became apparent that a huge barrier keeping many people in poverty was a lack of access to affordable start-up capital. Conditions there were perfect for microfinance, but the political situation meant it simply hadn’t happened. We were naïve enough to give it a go. The ZMF Bank came into being, and we set up ADC back in New Zealand to support it. Early on, funds to capitalise ZMF were spirited through Yangon airport and exchanged for large bundles of local currency by nameless strangers in musty underground rooms, before being hidden in our packs for the journey north to Kalaymyo. This journey was usually either on a run-down old government plane or on a 24-hour bus ride over seemingly impassable roads – both equally frightening. During our early visits we were also shadowed by Military Intelligence and subjected to curfews, checkpoints and tight restrictions on where and how we could travel. We were not allowed to meet with more than five people at a time. However, the challenges and risks we encountered pale in comparison to those faced almost constantly in the early years by the incredible group of locals whose courage and determination drove the ZMF dream from the outset.

A decade on, ZMF is flourishing. To date over 6,000 loans have been provided, with a combined value of more than $1.2 million. ZMF’s clients (over 85% of whom are women) continue to thrive, pulling themselves and their families out of poverty through successful small businesses. We have both been fortunate enough on a number of occasions over the years to witness first-hand the difference microfinance is making in the lives of ZMF’s clients. The bank’s success is a testament to the enormous passion and energy of the dedicated local staff, as well as the loyal support of the ADC community back here in New Zealand. We feel hugely privileged to have been part of the ADC Microfinance journey so far. But the most exciting thing is that this feels like it’s still just the beginning.” - Andy Colgan and Geoff Cooper Our hugely popular ADC Annual Quiz Night is back! This year we’re teaming up with Evolve to make it bigger and better than ever.

Come along on Saturday 30 September, 6.30pm for a fun and entertaining evening of trivia, spot prizes, live and silent auctions and more! Freemans Bay Community Hall, 52 Hepburn Street, Freemans Bay, Auckland. Tickets are $40 per person with teams of up to eight per table (or $300 for a whole table of eight). Please read the booking instructions (below) carefully. All proceeds will go to supporting our partner microfinance project in Myanmar. BYO beer/wine and food (or pre-book a yummy platter with your tickets). Snacks, tea, coffee and juice will be provided. Book now to avoid disappointment as the night is always a sell-out. Look forward to seeing you there! BOOK YOUR TICKETS HERE. |

Upcoming eventsArchives

April 2024

Categories |

|

CONTACT US DONATE POLICIES All content copyright © 2015 ADC Incorporated. ADC Incorporated is a registered charity under the Charities Act 2005 (Registration CC50855). |

© COPYRIGHT 2015. ALL RIGHTS RESERVED.

RSS Feed

RSS Feed